Recently, Pop Mart announced its 2024 full-year financial results, with a record-breaking revenue of 13.04 billion RMB, a year-on-year growth of 106.9%, and a net profit of 3.4 billion RMB, marking an astonishing 185.9% increase. Behind these impressive figures lies not only the rise of a trendy toy company but also the evolution of the entire industry. This article delves into Pop Mart's growth logic, analyzing their strategic layout, IP management, channel innovation, and globalization breakthroughs to provide valuable insights for other toy companies.

Strategic Restructuring: From Blind Box Manufacturer to Global IP Ecosystem Operator

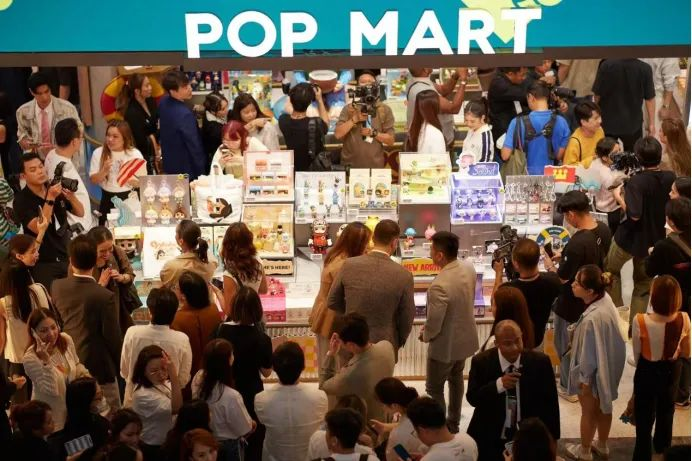

Under a dual-wheel strategy, Pop Mart has made significant strides in 2024, prioritizing "globalization" and "groupification" as core strategic goals. Data shows that overseas and Hong Kong, Macau, and Taiwan business contributed 5.07 billion RMB, marking a staggering 375.2% increase, representing 38.9% of total revenue. The Southeast Asian market became a central growth engine, with revenue of 2.4 billion RMB and a growth rate of 619.1%. Pop Mart's flagship stores in Ho Chi Minh City, Vietnam, and Bangkok, Thailand, recorded daily sales of over 5 million RMB, demonstrating the success of localized operations. The brand has utilized "cultural symbols + localized design" to launch collaborations like the Louvre Paris Art Series and the Indonesian Tropical Series, achieving breakthroughs in both cultural and commercial value.

The group's strategy has also driven diversification across product categories, with plush toys (2.83 billion RMB, +1289%) and the MEGA Series giant figures (1.68 billion RMB, +146.1%) emerging as new categories. Revenue from figurines dropped from 62.7% to 53.2%, signaling the transformation from a single blind box business to a comprehensive IP ecosystem. The management has set a revenue target of 20 billion RMB by 2025, with overseas markets aiming for 10 billion RMB, signaling Pop Mart's global ambitions.

IP Management: A Gradient Operational Model

Pop Mart's core strength lies in the continuous incubation and operation of IPs. In 2024, its four top-performing IPs (THE MONSTERS, MOLLY, SKULLPANDA, CRYBABY) collectively contributed over 7.5 billion RMB in revenue. THE MONSTERS led with 3.04 billion RMB, a growth rate of 726.6%, while CRYBABY surged into the "billion club" with an incredible 1537.2% growth. With 13 IPs generating over 100 million RMB in revenue, Pop Mart has established a healthy "leading IPs providing stable output + emerging IPs rising rapidly" operational structure.

Through "content-driven operations," Pop Mart extends the lifecycle of its IPs. The "Warmth" series of SKULLPANDA has sold over 790,000 sets, and the "Palace Mythical Beasts" series from MOLLY's collaboration with the Forbidden City has achieved both cultural and commercial success. This gradient model ensures that core IPs remain vibrant while new growth points are continuously nurtured.

Channel Innovation: Creating an All-Scenario Consumer Ecosystem

Pop Mart has significantly upgraded its offline experience in 2024, with 38 new stores in Mainland China, bringing the total to 401 stores. Robot stores increased to 2,300. Despite slower store growth, single-store efficiency saw a marked improvement, with offline store revenue reaching 3.83 billion RMB, a 43.9% year-on-year increase, and robot store revenue hitting 700 million RMB, a 26.4% growth. Flagship stores have incorporated AR interaction, and theme pop-up stores combined with holiday marketing have enhanced user engagement. In international markets, flagship stores in Bangkok, Thailand, and Oxford Street, UK, serve as models for Pop Mart's successful "landmark shopping district + localized design" strategy.

Online channels also performed well. The blind box machine mini-program earned 1.11 billion RMB, marking a 52.7% growth, and Tmall flagship stores generated 630 million RMB, growing by 95%. Self-operated live-streaming rooms, with vertical operations across multiple product categories, achieved 600 million RMB in revenue, a 112.2% growth. Membership systems played a crucial role in driving private domain growth, with 46.08 million registered members in Mainland China, contributing 92.7% of total sales and a 49.4% repurchase rate. Cross-border e-commerce platforms like Shopee and TikTok saw explosive growth, with TikTok revenue surging by 5779.8%.

Globalization 3.0: From Regional Expansion to Cultural Output

Pop Mart has strategically divided its overseas markets into four regions. Southeast Asia, contributing 47.4% of revenue, remains the dominant region. Countries like Vietnam, Indonesia, and the Philippines have quickly penetrated the market through a combination of offline stores and online platforms. Pop Mart's revenue from the Southeast Asian region grew by 619.1%, reaching 2.4 billion RMB, nearly half of total overseas revenue. North America, with revenue of 720 million RMB, achieved a growth rate of 556.9% and became the second-largest growth driver. The brand leveraged collaborations with IPs like Disney and Marvel to break into the European and North American markets. The Louvre Paris store performed exceptionally well, and Pop Mart's North American team consists entirely of foreign employees.

Management has shared that Europe will be a key focus in 2025, aiming to elevate its high-end positioning through artistic collaborations. The past year saw rapid growth across all four overseas regions, with overall revenue almost quadrupling. In Southeast Asia, revenue grew by 619.1%, reaching 2.4 billion RMB, representing nearly half of total overseas revenue. With 60% of revenue coming from offline stores, Pop Mart’s expansion strategy heavily relies on physical retail, with plans to open landmark stores in major cities worldwide.

Operating Efficiency: Digital-Driven Precision Management

Pop Mart's gross profit margin reached 66.8% in 2024, a historical high, improving by 5.5 percentage points compared to 2023. This improvement is attributed to a higher proportion of high-margin overseas channels, increased self-produced products (reducing reliance on external suppliers), and optimized supply chain costs. The share of self-produced products rose from 62.7% to 68.3%, while outsourced products decreased to 31.7%.

The company also optimized inventory turnover, reducing the number of inventory days from 133 (industry average: 180+) to just 102 days. Pop Mart's plush category grew by an impressive 1289%, with the design-to-launch cycle for products shortened to just 45 days. Through digital systems monitoring sales data, Pop Mart dynamically adjusts production plans, allowing quick responses to market demands and reducing inventory risks.

The Next Leap After 10 Billion RMB: Breaking Through Bottlenecks

As the trendy toy market becomes more competitive, Pop Mart faces challenges like IP homogenization and user fatigue. The secondary market's inflated prices could damage the brand's image, and some users have complained about "scalpers hoarding" and "hunger marketing." Furthermore, the Z-generation's increasing demand for "emotional value" creates more segmented market needs. To address these challenges, Pop Mart must establish a user insight system to capture dynamic preferences. International competitors like LEGO, HOT TOYS, and domestic brands such as TOPTOY continue to siphon market share, intensifying competition.

Strategic Expansion into Pan-Entertainment Ecosystems

Pop Mart's ambitions extend beyond toys. In 2024, the company ventured into new product categories like building blocks, jewelry, and games, and started laying the foundation for offline amusement parks and IP licensing. Management has set a target of 20 billion RMB in revenue for 2025, with overseas markets accounting for 10 billion RMB. To achieve this, Pop Mart must continue to innovate in IP development, cross-industry partnerships, and global operations. Meanwhile, it will need to address complex regulatory issues in international markets, including data privacy and intellectual property concerns.

Industry Insights: Breaking Through in the Trendy Toy 3.0 Era

1. Emotional Upgrade in User Operations

Pop Mart's membership system has entered maturity, with 46.08 million members contributing 92.7% of sales. Private domain operations have become a core barrier to entry. By combining "IP stories + social interaction + exclusive benefits," Pop Mart creates an emotional bond with its users, which will become a critical competitive advantage. In terms of globalization, prioritizing localized operations and integrating local cultural symbols with commercial scenes will be crucial. Pop Mart must avoid merely replicating domestic models and focus on enhancing emotional connections through storytelling and scenographic content.

2. Channel Revolution through All-Scenario Synergy

By constructing a full-channel ecosystem combining "offline experience + online viral growth," Pop Mart leverages private domain traffic to enhance customer lifetime value (LTV). Online channels grow through algorithmic recommendations and precision marketing, while offline stores provide not just sales but also immersive experiences and social spaces. Pop Mart's three-tier system—theme stores, pop-up shops, and robot stores—forms a seamless consumption loop.

3. Flexible Innovation in Supply Chain Management

In response to the unpredictable nature of IP trends, Pop Mart has established a "small batch + quick response" mechanism to ensure a 30-day design-to-launch cycle. Using data-driven insights, Pop Mart optimizes production and inventory management, allowing the company to respond swiftly to market fluctuations. This flexible supply chain model has set a benchmark in the industry.

Conclusion

Pop Mart's 2024 performance is a victory not only for the company but also marks the transformation of Chrateinese trendy toy brands from "followers" to "leaders." For toy companies, Pop Mart's success offers three core lessons: build an ecosystem centered on IP, innovate experiences with a user-centered approach, and expand globally with a forward-thinking stgy. Driven by new consumer trends and cultural confidence, Chinese toy companies are making the leap from "manufacturing advantages" to "cultural export," and we can expect more brands to follow in Pop Mart's footsteps, writing their own "Pop Mart-style" success stories in the global market.